The Feed-in Tariff (FiT) scheme greatly encouraged the uptake of solar panels in households and businesses across the UK.

It was designed to promote the adoption of renewable, low-carbon electricity generation by offsetting initial costs with more certain returns.

Tariffs under the scheme were set to give rates of return between 5% and 8%, encouraging investment and giving people a direct stake in the transition to a low-carbon economy.

In April 2019, the FIT scheme stopped taking on new applicants, and the Smart Export Guarantee (SEG) took its place in January 2020.

Installations already registered under the FiT scheme are still supported. Solar systems will continue to receive payments for up to 20 years from the date of commissioning or 25 years if you signed up before August 2012.

Quick Takeaways:

- The Feed-in Tariff created a financial incentive that increased the adoption of solar panels and other renewable energy technologies

- The scheme paid installers to generate and export renewable energy

- Tariff rates were influenced by technology type, the installed capacity, energy efficiency, and degression mechanisms

What Was the Feed-In Tariff?

The Feed-in Tariff was a government scheme introduced by the Department of Energy and Climate Change (DECC) in April 2010.

It was designed to incentivise the uptake of small-scale renewable energy technologies like solar panels.

The scheme requires some electricity suppliers to pay fixed tariffs to households and businesses for the renewable electricity they generate and export to the grid.

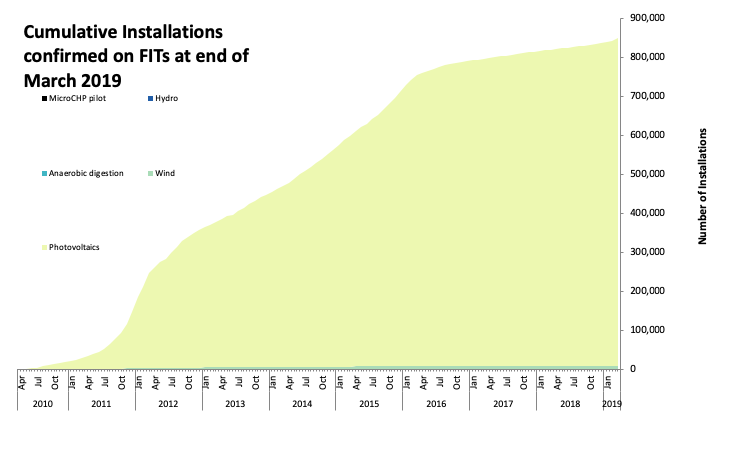

The financial incentive made the FiT scheme popular, rapidly increasing domestic solar panel installations.

Cut Your Energy Bills with Solar in 90 Seconds

Get your free fixed-price quote from Heatable — a Tesla Premium Installer with no hidden fees or sales pressure.

- ✔ MCS-accredited & Which? Trusted Trader

- ✔ Fixed price guarantee — no surprise costs

- ✔ Finance available & deposit protection

- ✔ Rated 4.9★ by thousands of UK homeowners

By the end of year 5 of FiT’s operation, there were over 674,000 solar panel installations, representing 99% of the total installations under the scheme.

Other supported technologies include hydropower, onshore wind, micro-combined heat and power (micro-CHP), and anaerobic digestion (AD).

What Were the Objectives of the Feed-In Tariff?

The FiT scheme was introduced in line with the UK’s 2050 decarbonisation targets. Renewable energy adoption was sluggish before the scheme, and high upfront costs deterred many potential investors.

With increasing pressure to reduce reliance on fossil fuels and meet legally binding carbon reduction targets, the government set various objectives for the FiT:

- Encouraging small-scale low-carbon electricity generation (up to and including 5mw)

- Empowering people and offering a direct stake in the transition to a low-carbon economy

- Helping the public to adopt carbon reduction measures

- Encouraging change in energy use behaviour

- Helping reduce energy costs and develop local supply chains

Experiences from other policy measures like the Renewables Obligation informed the scheme.

They showed that uptake among individuals, communities, and businesses outside the energy sector could be encouraged through a simple, accessible policy framework.

Related solar guides:

- How many solar panels do you need?

- Smart Export Guarantee

- Can you install solar panels in a conservation area?

- Best 4kw solar system with battery storage

- Sunshine hours map UK

- Best Solar Panels

- Solar panel output calculator

How Did the Feed-In Tariff Scheme Work?

The FiT scheme was simple. Install a renewable energy system at your property, connect it to the grid, and receive payments based on how much electricity you generate and export. You could get payments under two categories:

- The Generation Tariff — The main payment for every kilowatt-hour (kWh) of electricity you generate, regardless of whether you use it or export it to the grid. In 2010, the initial generation tariff rate for retrofit solar panels with a maximum capacity of 4 kw was 71.5p/kWh, but it has decreased over time as the costs of solar panels have reduced.

- The Export Tariff — You could also send any surplus energy you did not use to the electricity grid and get an extra payment for the exported electricity. The original export tariff rate was 3p/kWh, but it was increased to 4.50p/kWh for new solar systems installed after 1 August 2012.

Licensed electricity suppliers pay for the scheme’s cost through a levelisation process that allocates different proportions depending on their share of the electricity market.

The tax-free payments are adjusted annually for inflation and guaranteed for the panel’s eligibility period, offering decent returns over time.

How Were Payments Calculated?

Various factors influenced the tariff rate assigned to an accredited installation:

The Technology Type

Different renewable energy technologies had different tariff rates because their costs and generation capacities varied widely:

- Solar PV: Received higher tariffs initially due to high upfront costs, but saw rapid reductions as prices fell.

- Wind Power: Tariffs depended on system size, with small turbines receiving higher rates than larger installations.

- Hydropower: Rates reflected the costs of constructing and operating small-scale hydro systems.

- Anaerobic Digestion: Offers tailored rates due to its specialised nature and potential benefits in waste management

Technologies that were accessible and scalable by small-scale producers, such as solar panels, were prioritised by the government.

The Total Installed Capacity

The government adjusted tariffs based on the renewable energy system’s total installed capacity or size.

The FiT marked a new approach to renewable technology deployment by providing higher tariffs to smaller installations than larger ones.

Small-scale systems, like those equal to or less than 4 kW, enjoyed higher rates to encourage residential and small business adoption.

Medium-scale systems ranging from 4–50 kW had slightly lower rates as economies of scale reduced costs. Large-scale systems above 50 kW had lower rates to avoid excessive subsidies for commercial projects.

For example, solar systems with a capacity equal to or less than 4 kw had a generation tariff of 43.3p/kWh, while that of systems with a capacity greater than 50 kw was 19p/kWh.

This tiered approach ensured fairness and targeted support for smaller generators who might otherwise struggle with the high entry costs.

The Energy Efficiency of the Property

The government introduced minimum energy efficiency standards to encourage improvements in property energy efficiency.

This significantly impacted eligibility for Feed-in Tariff (FIT) rates and payments, especially for solar panel systems. Tariff rates for solar panel installations were split into:

- Higher: An EPC of level D or above before the commissioning date of the installation.

- Middle: An EPC of level D or above before the installation’s commissioning date, and the owner is a multi-site generator.

- Lower: An EPC below level D before commissioning.

Properties with an EPC rating of band D or above qualified for higher FIT generation tariff rates, while those with a rating below band D received lower rates.

Eligible community and school installations received a reduced minimum energy efficiency requirement from an EPC band D to band G and above to allow them to obtain higher generation tariff rates.

Degression Mechanisms

The government introduced quarterly degression, or a gradual decrease in tariff rates, to reduce returns.

In some cases, this was from double to single digits. It also introduced more frequent reductions after an unanticipated drop in the cost of solar systems.

Tariff rates for new applicants were also reduced more frequently due to capacity triggers when the uptake of a particular technology, like solar panels, exceeded a certain threshold.

Degression ensured the FiT scheme remained affordable while providing sufficient incentives for new installations.

Are Old Applicants Still Receiving Feed-In Tariff Payments?

Yes. Installations registered before the FiT scheme’s closure will continue to receive payments for up to 20 years from the date of commissioning or 25 years if you signed up before August 2012. The export rate you get is influenced by the commissioning date.

For example, according to the latest tariff rates from 1 April 2024 to 31 March 2025, if you installed your solar panels on or after 1 August 2012, you currently receive a rate of 7.14p for every kilowatt hour of electricity you send to the grid. If you commissioned your system between April 2010 and July 2012, you currently receive 5.07p/kWh.

For generation payments, you’ll need to know 2 or 3 things to determine your tariff:

- Your eligibility or tariff date

- The technology and capacity of your system

- Whether you qualify for a higher, middle, or lower tariff if you installed your solar system after April 2012

For example, if you own a standard 4kw-10kw solar system with an eligibility date between 1 April 2010 and 31 March 2011, you currently earn 62.67p for every kWh your system produces.

The rates have varied widely over the years. If you installed the same system between 1 January 2017 and 31 March 2017, you currently earn 5.83p/kWh if you qualify for the higher tariff and only 0.74p/kWh if you qualify for the lower tariff.

Early adopters typically received higher rates to compensate for the higher upfront costs, but the rates were adjusted for new customers to reflect the declining prices.

Ofgem adjusts the tariff rates for the FiT scheme annually according to the Retail Price Index (RPI). From 1 April 2024, Ofgem adjusted the tariffs by an RPI of 5.2%.

Can You Change Your Feed-In Tariff Licensee?

Yes. You can change your feed-in tariff licensee or the licensed electricity supplier making FiT payments if you wish.

However, the FiT payments will remain the same regardless of the electricity company that pays them because the government sets the rates.

Large electricity suppliers must act as FIT Licensees, while smaller suppliers can choose to become licensees.

According to the scheme administrator, all licensed electricity suppliers must participate in some aspects of the FIT scheme regardless of their FiT status.

If you want to change your licensee, you should approach a new supplier with the request. The new supplier will note your request to switch and the date on which the switch will take place on the Central FiT Register (CFR).

Your current licensee will review and approve the switch, provided there are no objections.

During the process, the new supplier will ensure it has received all the necessary information about you and the previous FiT licensee.

They will also carry out checks to confirm the ownership of the installation and ensure they make FiT payments correctly.

The new licensee will then complete the switch and issue you with a new statement of FiT terms. All installations sharing the same meter must be switched to the same licensee.

The new licensee will pay all FiT payments from the switch date, and the old licensee will be obliged to clear all FiT payments due to you up to the switch date.

What Were the Benefits of the Feed-in Tariff?

Accelerated Solar Panel Adoption

By the end of March 2019, there was 6.2 GW of installed capacity confirmed on the FiT scheme, covering 849,109 installations. Solar photovoltaics (PV) represented 80% (5.0 GW) of the total installed capacity and 99% (839,501) of all installations.

Financial Returns for Participants

FiT continues to provide a financial boost for many households. Installers registered under the scheme can earn additional income through tariff payments while saving money by generating free electricity.

Carbon Emission Reductions

With millions of kilowatt-hours of clean electricity generated under the scheme, the FiT played a pivotal role in reducing the UK’s carbon footprint.

Energy Independence

Decentralised energy generation reduced strain on the national grid and empowered individuals to become self-reliant in their energy needs.

Job Creation

The scheme stimulated growth in the renewable energy sector, creating installation, manufacturing, and maintenance jobs. Solar panels alone supported over 15,000 jobs in 2,200 enterprises between 2012 and 2013.

What Were the Criticisms and Challenges of the Feed-In Tariff?

Like any large-scale policy, the FIT scheme wasn’t without its critics.

Cost to Consumers

The costs of funding the FIT were passed on to energy consumers through their bills.

Critics argued that this disproportionately affected lower-income households, who were less likely to afford renewable energy installations themselves.

Reduction in Tariffs

Over time, the government significantly reduced the tariff rates to reflect falling technology costs, leading some to accuse it of dampening enthusiasm for new installations.

Administrative Complexity

Some participants found the registration process cumbersome, particularly in the early days of the scheme.

Policy Uncertainty

Frequent changes to tariff rates and deadlines created uncertainty, potentially discouraging some from investing in renewable energy technologies.

Final Thoughts

The Feed-in Tariff empowered UK households, businesses, and organisations to take control of their energy use, sparking a renewable energy revolution and laying the groundwork for a more sustainable future.

Although the scheme is no longer active, its legacy is evident in the many solar panels and wind turbines across the country.

Sources and References:

- https://assets.publishing.service.gov.uk/media/5a819fd0ed915d74e623343b/FIT_Evidence_Review.pdf

- https://www.ofgem.gov.uk/publications/feed-tariff-fit-tariff-table-1-april-2024

- https://www.ofgem.gov.uk/environmental-and-social-schemes/feed-tariffs-fit/electricity-suppliers

- https://www.gov.uk/government/statistical-data-sets/monthly-central-feed-in-tariff-register-statistics

💷 Learn more about finance, costs & tariffs:

- Why is electricity more expensive than gas?

- Solar panel finance

- Solar panel costs

- Solar panel cost calculator

- VAT on solar panels

- Smart Export Guarantee rates

- Feed-in tariff

- Average monthly electric bill with solar

- British Gas EV tariff

- Best EV tariffs UK

- Rent a roof

- Free solar panels

- Leasing solar panels